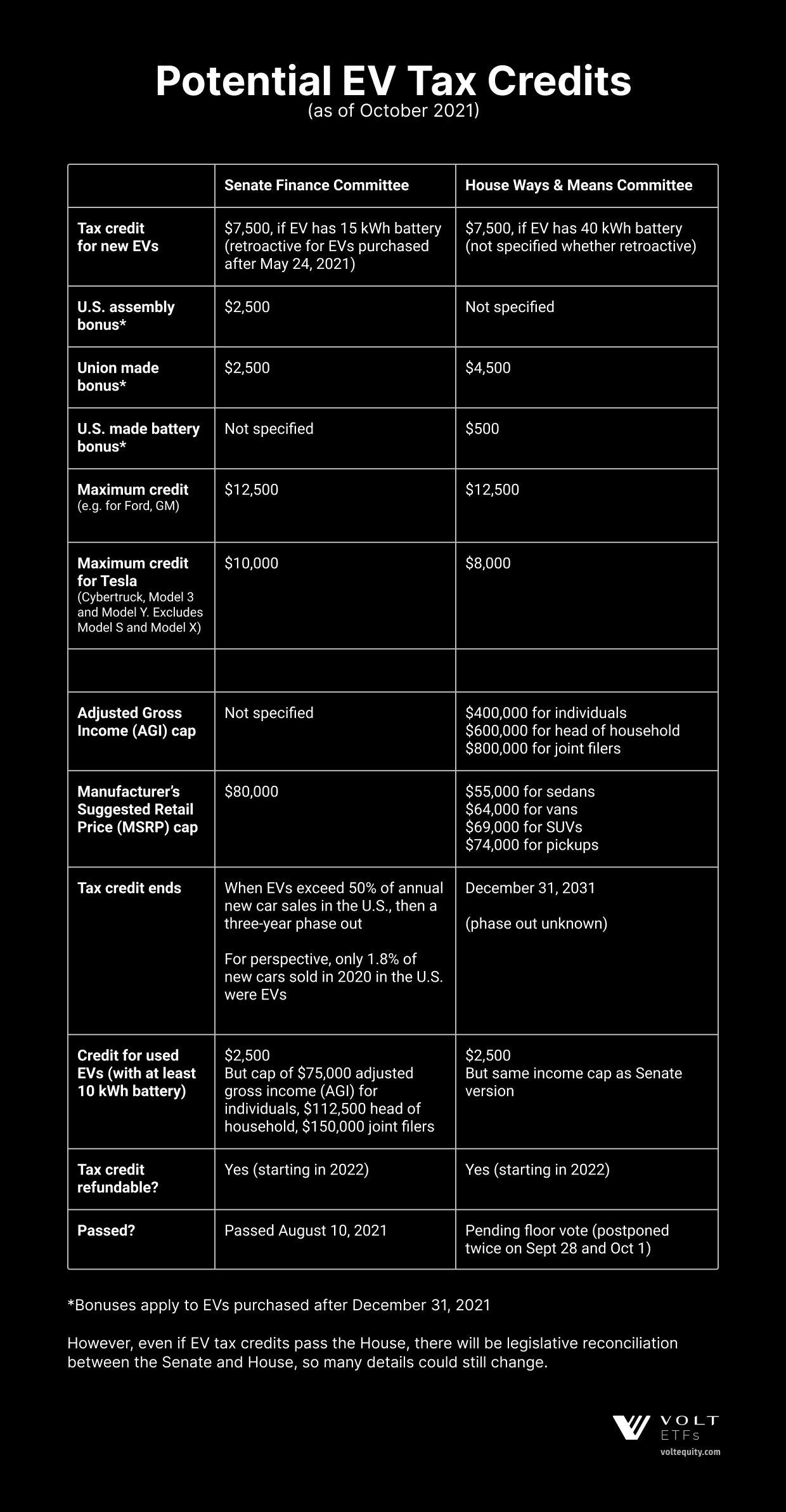

Retroactive Tax Credits 2024 Meaning Definition – Here’s what an EV needs to qualify for the federal tax credit in 2024: Those last three requirements are among the biggest reasons why this list looks different now than it did back in early 2023. . The Inflation Reduction Act offers a tax credit worth up to $7,500 to those who buy new electric vehicles. It also offers a $4,000 credit for used EVs. New rules for 2024 will allow buyers to get .

Retroactive Tax Credits 2024 Meaning Definition

Source : www.voltequity.com

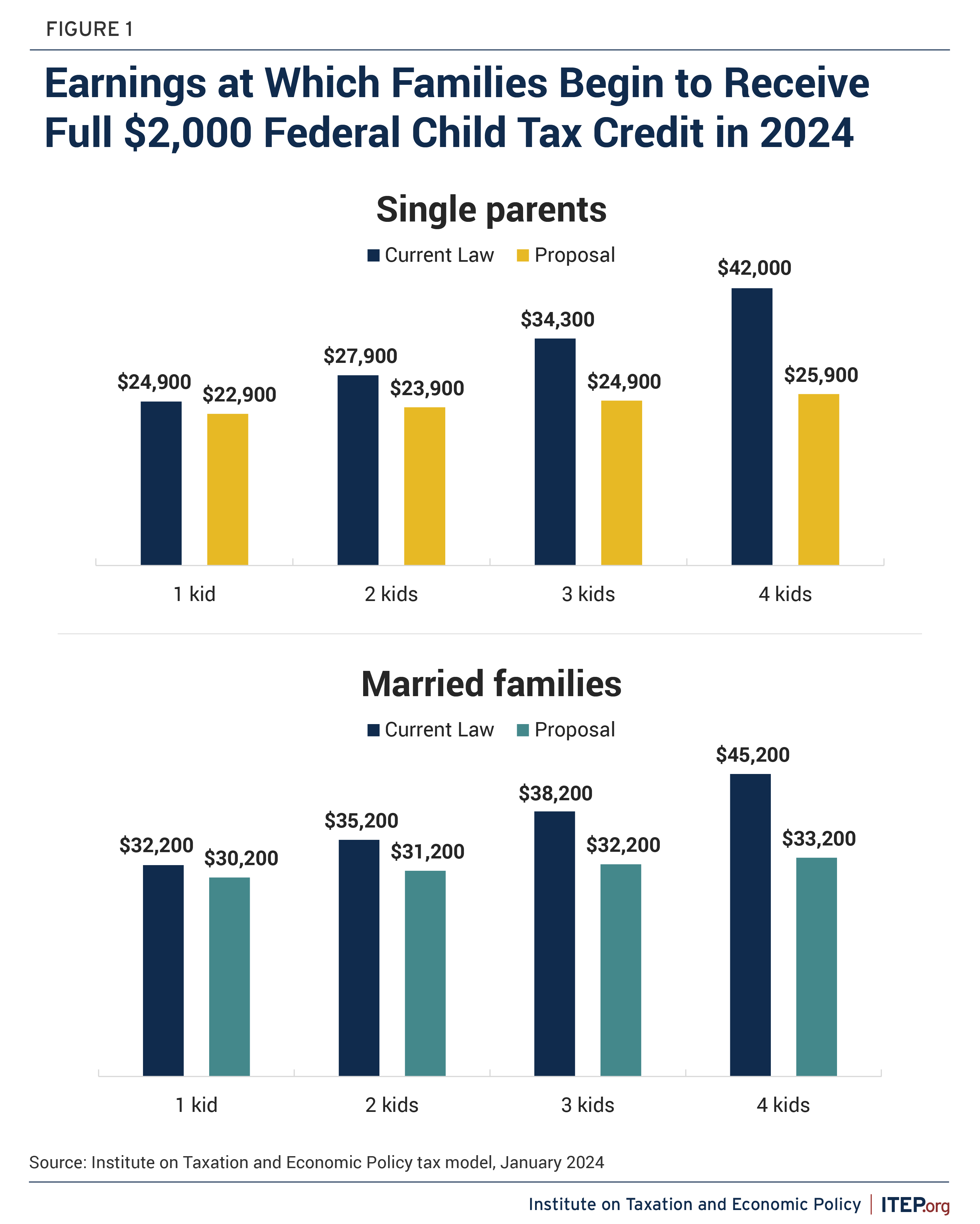

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

Can You Still Claim the Employee Retention Credit (ERC)?

Source : www.investopedia.com

fox news lower taxes 2024|TikTok Search

Source : www.tiktok.com

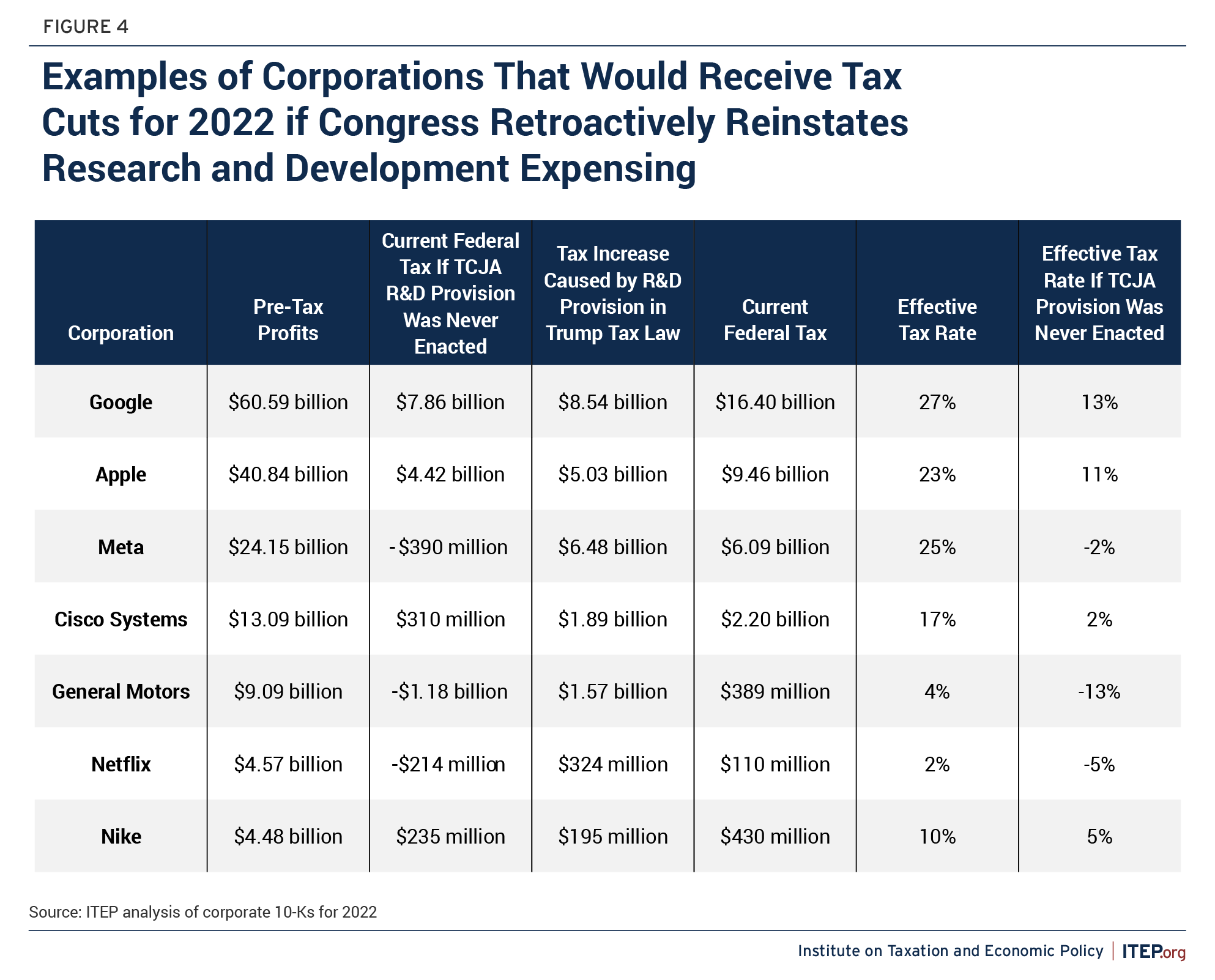

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

senator says dont file your taxe yet|TikTok Search

Source : www.tiktok.com

senator says dont file your taxe yet|TikTok Search

Source : www.tiktok.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

New Electric Vehicle and Home Energy Tax Incentives WSJ

Source : www.wsj.com

Retroactive Tax Credits 2024 Meaning Definition The Tesla EV Tax Credit: A $7,500 tax credit for electric vehicles will see substantial changes in 2024. It will be easier to the dealer that $7,500 — effectively meaning the tax credit is being handled through . What to expect for 2024 is refundable, meaning it can be received as a tax refund if you qualify. However, there are income thresholds that must be met to claim this credit. .

:max_bytes(150000):strip_icc()/Employee-retention-credit-25270655c72840d5ab9012169ef9e21d.jpg)